Our Strategy

Parachute Investing purchases under-performing workforce housing in secondary and tertiary markets which demonstrate signs of economic growth and demographic strength. Whether it be a “tired landlord,” a retiring landlord, or a number of other “problems” to solve for the current property owner, Parachute seeks opportunities where we can add value - for the tenants who live there, for our investors, and for us.

Upon acquisition, Parachute brings in a local property management company to operate the property. While property management runs the day-to-day, Parachute does the asset management and oversees the property manager.

How We Add Value

From day one of ownership, Parachute aims to increase each asset’s profitability by:

Implementing capital improvement programs

Driving rental income higher

Decreasing operational expenses by creating efficiencies and systems.

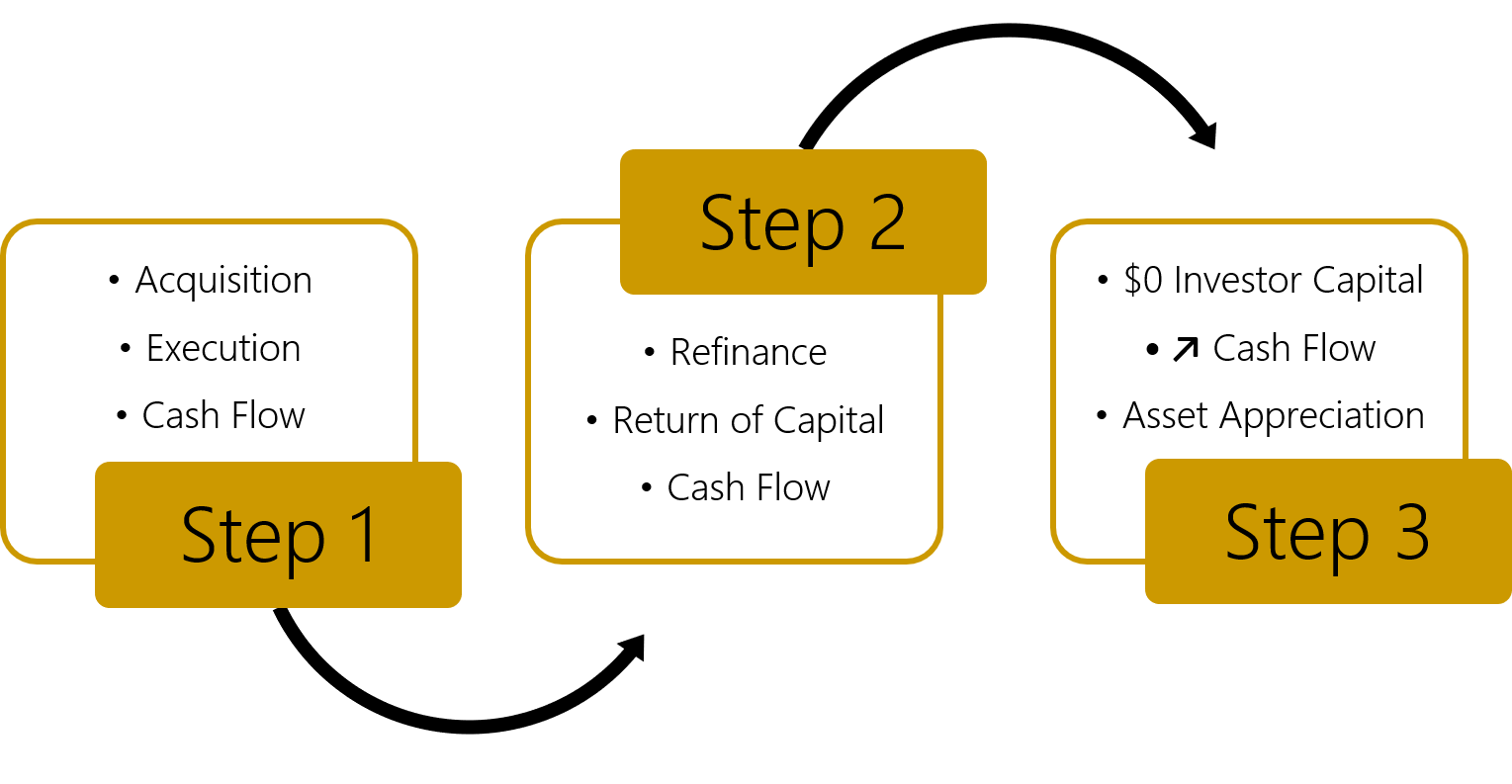

Deal Timeline

After driving NOI higher, Parachute refinances the property into permanent debt, returns investor capital, and enjoys - along with our investors - all the fruits of cash flowing, appreciating and tax-advantaged long-term real estate ownership.

Partner with Parachute

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

— Franklin Delano Roosevelt